National Clean Up Your IRS Act Month on March, 2025: does anyone know when medical records day is celebrated?

March, 2025 is National Clean Up Your IRS Act Month 2025. 100% Free IRS Tax Filing You can eFile your IRS Taxes Today! Free Filing w/TaxACT. You Got This.

I got 0 hits in Google for "National Medical Records Day".

does not list it. I made a partial list below, as proof of their extensive data base. All in all, I do not think it exists.

March is . . .

Adopt A Rescued Guinea Pig Month

American Red Cross Month

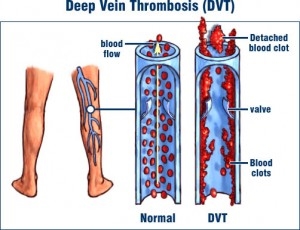

Deep Vein Thrombosis (DVT) Month

Deaf History Month

Employee Spirit Month

Expanding Girls' Horizons in Science & Engineering Month

Honor Society Awareness Month

Humorists Are Artists Month

International Expect Success Month

International Ideas Month

International Listening Awareness Month

International Mirth Month

Irish-American Heritage Month

Music In Our Schools Month

National Caffeine Awareness Month

National Cheerleading Safety Month

National Chronic Fatigue Syndrome Awareness Month

National Clean Up Your IRS Act Month

National Colorectal Cancer Awareness Month

National Craft Month

National Ethics Awareness Month

National Eye Donor Month

National Frozen Food Month

Where can I find a list of appreciation and awareness months?

Full List of Awareness Dates

January

1-31 National Blood Donor Month

1-31 Cervical Cancer Awareness Month

1-31 Poison Prevention Awareness Month

1-31 Financial Wellness Month

4-11 Women's Self-Empowerment Week

7-11 National Thank Your Customers Week

17 Customer Service Day

21-27 Hunt For Happiness Week

25-31 NYC Restaurant Week

29 Chinese New Year

February

1-30 Marfan Syndrome Awareness Month

1-30 National Parent Leadership Month

1-30 Plant The Seeds Of Greatness Month

1-30 Library Lovers Month

1-30 Youth Leadership Month

1-30 National Weddings Month

1-30 Time Management Month

1-30 American Hear Month

1-30 Black History Month

1-7 Women's Heart Health Week

6 Ash Wednesday

6-13 National Patient Recognition Week

11-18 Heart Failure Awareness Week

12 Abraham Lincoln Birthday

12 NAACP Founded

14 Valentines Day

15 Susan B. Anthony Day

17 George Washingtons Birthday

18 Presidents' Day

March

1-30 American Red Cross Month

1-30 National Parent Leadership Month

1-30 Honor Society Awareness Month

1-30 Irish-American Heritage Month

1-30 National Athletic Training Month

1-30 National Caffeine Awareness Month

1-30 National Chronic Fatigue Syndrome Month

1-30 National Clean Up Your IRS Act Month

1-30 National Collision Awareness Month

1-30 National Ethics Awareness Month

1-30 National Eye Donor Month

1-30 National Kidney Month

1-30 National Multiple Sclerosis Education and Awareness Month

1-30 National Nutrition Month

1-30 National Social Work Month

1-30 National Womens History Month

1-30 National Write a Letter of Appreciation Week

1-30 Poison Prevention Awareness Month

1-30 Steroid Abuse Prevention Month

April

1-30 Alcohol Awareness Month

1-30 Cesarean Awareness Month

1-30 Cancer Control Month

1-30 Irritable Bowel Syndrome Awareness Month

1-30 Jazz Appreciation Month

1-30 National Autism Awareness Month

1-30 National Child Abuse Prevention Month

1-30 National Infant Immunization Month

1-30 National Occupational Therapy Month

1-30 National Oral Health Month

1-30 Women's Eye Health and Safety Month

3 Sexual Assault Awareness Month Day of Action

3 National Public Health Week (Climate Change)

4-10 Brain Tumor Action Week

5 Kick Butts Day (Tobacco-Free Kids)

6 National Alcohol Screening Day

7 World Health Day

11 National D.A.R.E. Day

11 World Parkinson's Day

14 Children With Alopecia Day (Alopecia Awareness)

16-20 Consumer Awareness Week

16 World Hemophilia Day

17 National Stress Awareness Day

20 Passover

19-26 National Infant Immunization Week

20-26 National Window Safety Week

21-28 Administrative Professionals Week

22 Earth Day

23 Administrative Professionals Day

25-30 National Oral, Head, and Neck Cancer Week

26 March for Babies (Walk America)

May

1-31 Haitian Heritage Month

1-31 American Stroke Month

1-31 Asian Pacific American Heritage Month

1-31 Awareness of Medical Orphans Month

1-31 Family Wellness Month

1-31 Better Hearing and Speech Month

1-31 Better Sleep Month (Stress/Insomnia)

1-31 Clean Air Month

1-31 Correct Posture Month

1-31 Fibromyalgia Education and Awareness Month

1-31 Healthy Vision Month

1-31 International Victorious Woman Month

1-31 Lyme Disease Awareness Month

1-31 Melanoma/Skin Cancer Detection and Prevention Month

1-31 Motorcycle Safety Month

1-31 National Arthritis Month

1-31 National Athsma and Allergy Awareness Month

1-31 National Cancer Research Month month

1-31 National Celiac Disease Awareness month

1-31 National Hepatitis Awareness Month

1-31 National High Blood Pressure Education Month

1-31 National Mental Health Month

1-31 National Neurofibromatosis Month

1-31 National Osteoporosis Awareness and Prevention Month

1-31 National Physical Fitness and Sports Month

1-31 National Preservation Month

1-31 National Shoes for Orphans Month

1-31 National Stroke Awareness Month

1-31 Older Americans Month (Senior Citizens Month)

1-31 Skin Cancer Awareness Month

1-31 Tuberous Sclerosis Awareness Month

1-31 Women's Health Care Month

1-31 Ultraviolet Awareness Month

1 May Day

1 Ascension Day

1 Law Day

1 Loyalty Day

1 World Athsma Day

1 National Anxiety Disorders Screening Day

3 National Day of Prayer

3 United Nations World Press Freedom Day

3 Kentucky Derby

4-10 Brain Tumor Action Week

4-10 Be Kind to Animals Week

5 Cinco de Mayo

8 World Red Cross Day

8 VE-Day Anniversary

10 World Lupus Day

11 Pentecost

11 Mother's Day

12-16 National Neuropathy Week

12 World Fair Trade Day

12 International CFS Awareness Day

12 National Women's Check-up Day

14-25 Cannes Film Festival

15 Peace Officer Memorial Day

18 HIV Vaccine Awareness Day

19-25 Recreation Water Illness Prevention Week

24 National Schizophrenia Awareness Day

26 Memori

Can anyone explain the Fair Tax Act to me?

The grossly mis-named "Fair Tax" is an attempt by the wealthy to pass their tax burden onto the shoulders of the working poor and middle class. It would replace the income tax and Social Security and Medicare taxes with an enormous 30% (or higher!) national SALES TAX. The proponents like to say that it's a 23% "inclusive" rate but that's just one of many lies about it. It also includes a "prebate" feature -- a check from the government every month that is supposed to be large enough to defray the tax on the essentials of life. However the rate isn't applied evenly to all family members which will leave it wide open for fraud. And with a 30% tax clobbering the poor and middle class, black marketing will become a MAJOR problem.

You can Google "Fair Tax" and read up on their lies. Once you do that, come back and read the rest of this post. Maybe YOU will be able to answer my questions on it satisfactorily. If you can, you WILL be the first!

First off, the "inclusive vs exclusive" issue is smoke and mirrors to make a 30% tax look better. Sales taxes are ALWAYS added on to the selling price so the rate is 30%. Even Neil Boortz grudgingly agrees to this fact if pressed.

It's a GREAT deal if you're wealthy. If you're poor or middle class it will clean your clock.

Answer the following questions, please. If you can, you will be the FIRST "Fair Tax" proponent to do so! I've yet to have a single one of them address them, including Neil Boortz who hung up on me on his radio show and called me an idiot. I've interspersed my own commentary on the issues but feel free to tear it up with FACTUAL information -- platitudes are worthless.

1. If you are going to do away with the IRS, who will collect the tax. (It will still be the IRS, we'll just give them a sweet sounding name.)

2. How do you intend to deal with "prebate" fraud? (The IRS can't track income in real time -- it takes about 18 MONTHS to match W-2s with tax returns in the SAME computer system -- so how will they (or whomever) track family composition in real time?)

3. With a 30% tax on ALL new goods, how do you intend to deal with the massive black marketing that will result. (Any city or state with high tobacco or alcohol taxes will tell you that black marketing is a REAL problem.)

3a. OK, Congress dealt with that with tax stamps like on liquor and tobacco. (How about "The Audit of the New Millenium" now as armies of IRS agents decend on neighborhoods on trash day looking for evidence of untaxed goods. Or worse yet, burst into your home and rummage through your dresser looking for untaxed gruns and sex toys?)

4. How do you intend to deal with financing of the $60,000 tax on a new $200,000 home -- a modest price in much of the nation? (The home is still only worth $200,000 so the lenders won't lend the extra $60,000.)

4a. How will you deal with the collapse of the construction industry that will result from #4. (The resale market will take off, but new construction will grind to a hault.)

5. Ditto for the $6,000 tax on a new $20,000 car. (Same as #4.)

5a. How will you deal with the collapse of the auto industry in the US as a result of #5. (Before long US roads will look like Cuba with ancient pollution-belching relics being pushed along far past their sell-by dates.)

4b & 5b combined. Now that the US economy itself has collapsed following the collapse of its two primary movers, what next? (I'd LOVE to hear their answers on this!)

6. While you claim that the manufactureres of goods and the providers of services will reduce their prices due to the lack of corporate taxes, how to you plan on ensuring that that actually happens? (Sounds like quasi-communisim with central control on prices. Shudder!)

6a. And what about corporations that are bleeding money like Ford and GM and pay no income taxes since they're LOSING money. Where will THEIR price cuts come from?? THEIR costs will actually RISE as money spent on infrastructure investment will be taxed so their prices will RISE substantially. Uh-oh, Houston we have a problem!

7. How to you explain to the single mother with 2 kids that the EIC that she was depending upon for basic survival is being replaced by the "prebate" BUT she'll now pay about $5,400 in taxes that she didn't have to pay before? (Virtually every penny she earns pays for essential goods and services. She'll be cruicified by the added tax burden as she doesn't pay any income taxes now but WILL pay heavily under the co-called "Fair Tax.")

8. How do you plan to deal with the outcry from the World Trade Organization as untaxed American goods flood the global markets, shutting out imports in the US and local products overseas? (Hmmm... Go back to corporate income taxes? Whoops! There goes a prime argument for the "Fair Tax!")

9. How will you deal with the Paris Hiltons, Steve Forbeses, Bill Gateses (insert favorite rich person's names 1,500 times) who will simply make their major purchases overseas and bring them into the US as used and therefore tax-free. (Remember the failed Luxury Tax from the 80s that put yacht dealers out of business in droves and tossed their employees onto the unemployment and welfare lines.)

10. Finally, how to you explain to the middle class taxpayer earning $50,000 per year with a family of 4 and paying almost no income tax that he now has to pay $10,000 in taxes MORE than his "prebate" amount? (I'd love to hear that one too!)

I could go on for hours on the unintended consequences of the grossly misnamed "Fair Tax" but my fingers are getting tired. In the end it's a SWEET deal for the wealthy (who tend to amass wealth, not spend it all) but would crucify the poor and bring the middle class to their knees. The economists who dreamed this up have no focus on the social impact of this and were told to ignore any impact other than the bottom line for the US government. Hardly "Fair" IMHO.

The ONLY good tax is a graduated income tax. It's the ONLY tax that adheres to the first rule of taxation: Make sure that the taxpayer can AFFORD to pay the tax.

The wealthy support the misnamed "Fair Tax" or the Flat Tax since they'd pay MUCH less in taxes. If you lessen the burden on one group you either must cut services or transfer the burden to another group. That leaves the poor and middle class to shoulder the burden of a tax cut for the wealthy. Sorry, but I flatly refuse to subsidize your next BMW!