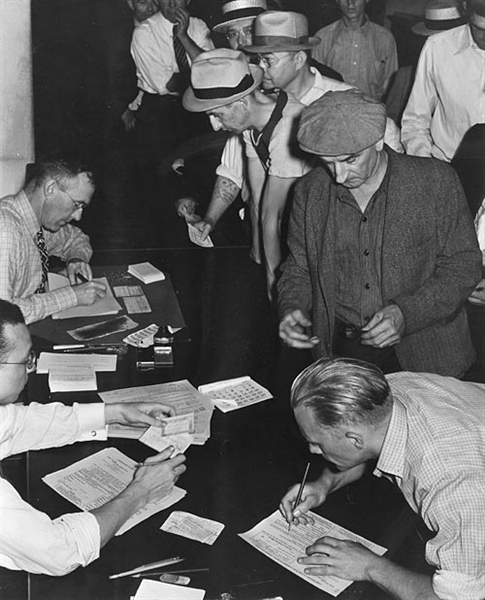

Social Security Day 2024 is on Sunday, August 4, 2024: Social Security Fraud?!?

Sunday, August 4, 2024 is Social Security Day 2024. My Social Security Benefits Over 100 Million Visitors. Discover and Explore on Ask.com!

Social Security's # is 1-800-772-1213. You can call or send a letter to your nearest social security office servicing your address (because, of course, that means that it also services the address of the person committing the fraud). Google "Social Security office address for (and then input your city and state)."

Include name and address of employer if the person is working. If you know when the work started that would also be helpful. If they're self-employed give as much info as you can about # of hours worked each day, how many days a week and what they're doing. If they aren't working but are receiving an income of some sort, provide the name and address of the agency or company paying the income.

I terminated many a benefit in the years I worked for Social Security for fraud reported by concerned citizens. Some people called, some came into the office and some wrote. If you write include their name and address. Date of birth would be helpful too. And especially their social security #.

WOW. I'm impressed by the Solution's answer. I can only say that he doesn't keep very good company and should consider running around with a different crowd of people. So cynical.

SOCIAL SECURITY HELP?

Social Security can't do anything about your problem even if you could contact them. They pay out the benefit when scheduled. Period. What happens to it once it goes into your account is your problem. If your $905 gets "sucked up" into your negative account then so be it. Social Security isn't going to give you more money because you aren't entitled to it.

It's the bank you need to contact - not social security. And frankly, I'm not so sure they'll help you either. I think you're in for a mighty poor month and it seems that the idiot isn't your brother. Just saying.

Social Security Question...?

Social Security retirement benefits are based purely on what you earned. They are unaffected by whether or not you collected unemployment benefits.

As for the calculation, which has been misrepresented here:

1. The SSA makes a list of every year you have ever worked, from zero to now.

2. The years that you were between 22 and 61 on the last day of the year are indexed for wage inflation. Years before you are 22 and after you are 61 are not indexed. (The idea is that these were your prime working years.)

3. Of ALL the years--whether they are indexed or not--the top 35 are kept. For men, this is usually an indexed year. For women, it may include some indexed years. If you have less than 35 years total, a $0 will be used. If you start to collect SSA benefits and continue to work, it's possible, but less likely, for the new income to displace an older year in the top 35. If it does, your benefits would go up a tiny bit.

4. The top 35 years are averaged to a monthly amount. This amount is then fed through a formula. The first $700-$800 is counted at 90%, the next $3000-$4000 is counted at 32% and anything above that is counted at 15%. (The formula shifts a little each year and I'm not going to go look it up.) If you collect before full retirement age, the amount is reduced.

The problem with unemployment is for the grand total used above if you don't have 35 "good" years.

In the unlikely event your income reached the Fica cap, only the capped amount is counted.

The other problem is if you apply for social security disability insurance. That is insurance if you can't work at all and looks at your earning history in the 10 years prior to the disability. If you are out of work for 10 years and then apply, the system won't give you anything.